For most Americans, Social Security income is a necessity to cover their expenses during their golden years. In 22 years of annual polling from Gallup, no fewer than 80% of then-current retirees noted a reliance, in some capacity, on their monthly Social Security benefit to make ends meet.

That’s what makes this next statement so worrisome: Social Security is in trouble.

America’s leading retirement program is facing the prospect of sweeping benefit cuts in under a decade, and the finger-pointing as to how this illustrious program got into this mess has begun.

Across social media message boards, no theory has gained more steam than the premise that Congress stole from Social Security and should return what it’s taken, in full, with interest. The idea here is that if lawmakers returned the cash that’s been removed from Social Security’s trust funds, the program would no longer be facing a long-term cash shortfall.

The all-important question is: Did Congress really steal money from Social Security?

Let’s take a closer look at whether this popular online belief is fact or fiction.

Social Security benefits could face sweeping cuts by 2033

Before diving into the specifics, it’s important to understand what’s at stake for the program’s over 50 million retired-worker beneficiaries, as well as the collective 67 million people currently receiving a monthly payout.

Every year, the Social Security Board of Trustees releases a report that effectively examines the financial health of the program. It provides a detailed balance sheet of revenue collected and dollars disbursed from the previous year, as well as offers short-term (10-year) and long-term (75-year) projections for Social Security that factor in things like fiscal and monetary policy changes and demographic shifts.

Since 1985, every Trustees Report has opined that Social Security was facing a long-term funding obligation shortfall. In plain English, revenue collection in the 75 years following the release of a report is estimated to be insufficient to cover outlays, including annual cost-of-living adjustments (COLAs). As of the 2024 Social Security Board of Trustees Report, the program is staring down a $22.6 trillion (and widening) funding obligation shortfall through 2098.

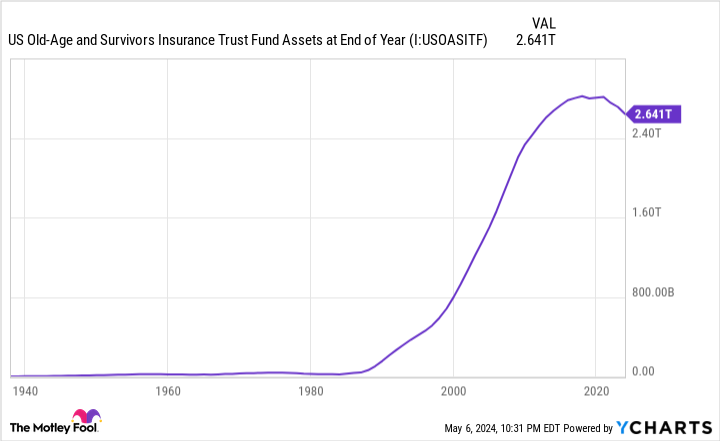

The bigger worry is what could happen in just nine years. The Trustees believe the Old-Age and Survivors Insurance Trust Fund (OASI), which is responsible for doling out monthly benefits to retired workers and survivor beneficiaries, could exhaust its asset reserves by 2033. If this extra capital built up since inception is depleted, monthly OASI benefits could be slashed to ensure no further need for reductions through 2098.

Something caused Social Security to work its way into a $22.6 trillion (and growing) deficit — but is Congress to blame?

Fact or fiction: Congress stole from Social Security?

While it’s easy to blame lawmakers for Social Security’s shortcomings, the idea that Congress pilfered funds from Social Security is 100% fiction.

In August 1935, the Social Security Act was signed into law by Franklin D. Roosevelt. Contained within this law is a provision that requires all excess cash to be invested in interest-bearing special-issue bonds. In other words, if Social Security brings in X amount of revenue, and the amount it pays out for benefits and administrative expenses in a given year is lower than X, there’s going to be a surplus of money that’s collected. This extra money, known as Social Security’s “asset reserves,” is required by law to be invested in special-issue bonds.

Imagine for a moment that you go to your local bank and purchase an interest-bearing certificate of deposit (CD) for $1,000. Although you’ve given your bank $1,000, it’s not going to let this cash sit in a vault and collect dust while paying you interest on your cash. The bank is going to loan out your money and aim to generate a higher rate of return than what it’s paying you in interest.

Even though you can’t see your $1,000, the bank hasn’t stolen it from you. It’s fully accounted for by your CD and backed by the federal government.

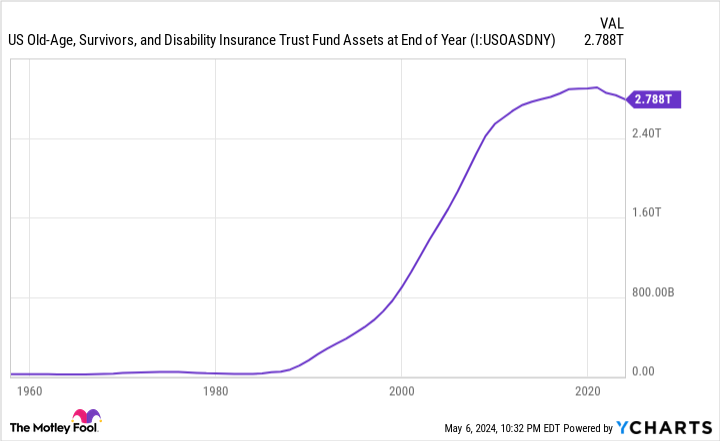

The same applies to Social Security’s OASI and Disability Insurance (DI) trust funds. Though they’re required by law to be invested in special-issue government bonds, every cent is fully accounted for, and these bonds are backed by the full faith of the U.S. government.

Additionally, the OASI’s and DI’s asset reserves are public data that’s updated monthly by the Social Security Administration. As of the end of March, the combined OASI and DI had about $2.767 trillion in asset reserves invested across an assortment of bonds and (to a lesser extent) certificates of indebtedness that were yielding an average interest rate of 2.429%. If you’re wondering why this rate is so low compared to current Treasury yields of around 5%, it’s because the program is constantly laddering its bond-buying activity, and not putting all of its eggs in one basket.

Hypothetically speaking, if the federal government were to repay every cent of this fully accounted-for $2.767 trillion, it would cost Social Security around $67 billion in annual interest income. In short, the program would actually deplete its asset reserves even faster without the federal government paying annual interest to the program.

One final thing I’ll add is that the federal government has never failed to make an interest payment to Social Security.

Therefore, the notion that Congress “stole from Social Security” is patently false.

Demographic changes have dug a $22.6 trillion hole for Social Security

However, I didn’t say Congress was absolved from the mess Social Security finds itself in.

One of the reasons Social Security is up a $22.6 trillion creek without a paddle is because lawmakers on Capitol Hill can’t agree on how best to fix it. Although there are plenty of proposals, neither Democrats nor Republicans have been willing to find common ground with their opposition. The longer this congressional stalemate goes on, the costlier it’s going to be for working Americans, and potentially retirees, to strengthen America’s leading retirement program.

Beyond congressional inaction, demographic shifts represent the root cause of Social Security’s growing funding shortfall.

Some of Social Security’s demographic changes are well-known by the public. Examples include the ongoing retirement of baby boomers, which is lowering the worker-to-beneficiary ratio, as well as a 13-year increase in life expectancy since the first retired-worker benefit was mailed out in January 1940.

But the far bigger issue for Social Security is what may not be as apparent.

For instance, net legal migration into the U.S. has declined every year since 1998 and plunged by an aggregate of almost 58% since its peak. Social Security relies on a steady stream of younger migrants into the U.S. who’ll spend decades in the labor force, providing valuable income via the payroll tax. If fewer legal migrants enter the U.S., it’s only going to weigh on the worker-to-beneficiary ratio and reduce future payroll tax revenue estimates.

Another problem is a historically low U.S. birth rate. While a significant decline in births isn’t an issue right now, it will become an issue in a generation when even fewer workers are replacing those retiring from the labor force.

As I’ve pointed in the past, income inequality is also worsening.

As of 2024, all earned income (wages and salary, but not investment income) between $0.01 and $168,600 is subjected to the 12.4% payroll tax. Meanwhile, earned income above this figure is exempt. Keep in mind that monthly benefits at full retirement age are also capped.

In 1985, just shy of 89% of all earned income was exposed to the payroll tax, with roughly 6.5% of workers hitting what was then the level where payroll taxation ceased. But as of 2021, only 81.4% of earned income was exposed to the payroll tax, with 6.2% of workers hitting this upper bound. More earned income than ever before is “escaping” payroll taxation.

There’s no question that Social Security has a lot of problems, but congressional theft simply isn’t one of them.

What stocks should you add to your retirement portfolio?

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now. The 10 stocks that made the cut could produce monster returns in the coming years, potentially setting you up for a more prosperous retirement.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $550,688!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

The Motley Fool has a disclosure policy.

Fact or Fiction: Congress Stole From Social Security and Should Return the Money It’s Taken, With Interest was originally published by The Motley Fool