Given the S&P 500‘s recent surge beyond 5,300, surpassing some experts’ year-end targets, is it prudent for investors to be concerned about a potential overheating in the market?

Goldman Sachs’ chief US equity strategist David Kostin believes that now that the S&P has climbed above the 5,200 target he’d predicted, there just isn’t much more room at the top this year. Kostin believes that the current combination of high stock valuations and low projections for 2024 GDP and earnings growth are likely to put a cap on stock gains. “Base case is in fact that the market will trade at around this level of multiple or in fact, even lower multiple as we come towards the end of the year,” Kostin says.

But don’t panic; this is not to say investors should abandon hope for the stock market. Despite the flat forecast from Kostin, the analysts at Goldman Sachs are pounding the table on two stocks, arguing they are well positioned to deliver handsome returns in the year ahead – in one case, as much as 108%.

We used the TipRanks database to take a closer look at these two Goldman picks; each has a ‘Strong Buy’ rating on the Street, and plenty of reasons to attract investors. Here are the details.

Fulcrum Therapeutics (FULC)

The first stock we’ll look at is Fulcrum Therapeutics, a Goldman pick from the realm of biopharmaceutical research. Fulcrum is focused on the development of new therapeutic agents for genetically defined diseases with both severe symptoms and high unmet medical needs. This is a potentially rich field, as current therapies have already proven ineffective or insufficient; a company that can successfully create an effective treatment in this area will make a dramatic impact on patients’ lives.

Fulcrum’s approach is based on the underlying genetics of the disease condition. The company has a proprietary product development platform, which it has dubbed FulcrumSeek and uses to identify targets for the drug candidates. The targets can be used to modulate gene expression, alleviating symptoms and modifying the disease course through treating the known causes of genetic mis-expression.

The company has two drug candidate programs in its pipeline that are in the clinical stages, losmapimod and pociredir. The first of these, a new compound under investigation in the treatment of facioscapulohumeral muscular dystrophy (FSHD), is the more advanced.

Losmapimod is currently the subject of the Phase 3 REACH trial, and Fulcrum reports that the drug is continuing to show progress. There are 260 patients enrolled in North America and Europe, and topline data is expected for release by the end of this year. Early data from the Phase 2 study ReDUX4 showed that losmapimod demonstrated improvements in functional, structural, and patient-reported outcomes.

In another development that should interest investors, Fulcrum has recently entered a collaboration and license agreement with Sanofi for the continued development and commercialization of losmapimod. Sanofi will pay $80 million up front in return for exclusive commercialization rights outside of the US, and Fulcrum also stands to receive up to $975 million in regulatory and sales-based milestone payments and royalties going forward. The two companies have also agreed to equally share the global development costs of the drug.

On the pociredir track, Fulcrum is currently running a Phase 1b clinical trial and has activated dosing cohorts 3 and 4. This drug is a potential treatment for hemoglobinopathies, including sickle cell disease (SCD), and the Phase 1b trial is evaluating the drug in the treatment of SCD. Each dosing cohort in this trial includes 10 patients.

For Goldman analyst Corinne Johnson, the key point to this company is the losmapimod development program. The drug is at an advanced stage of clinical testing, and Johnson sees plenty of potential in its further development. She writes, “We are positive heading into 4Q24 topline data for the Ph3 REACH study of losmapimod in facioscapulohumeral muscular dystrophy (FSHD) based on multiple factors. First, losmapimod has shown positive clinical data on the Ph3 REACH study primary endpoint reachable workspace (RWS) in the prior Ph2b study ReDUX4 (including the open-label extension) with a significant correlation to muscle fat infiltration (MFI) and alignment with patient-reported outcomes (PROs). Together these data provide a concordance of evidence for clinical benefit with the asset, which we view as de-risking. Second, our conversations with KOLs have shown support for losmapimod in FSHD with potential for robust patient uptake of the drug following approval. Last, losmapimod has a significant clinical development lead relative to competitors, setting it up to be a first-in-class agent in FSHD.”

This upbeat long-term outlook on the chief product leads Johnson to rate the stock as a Buy, and she complements that with a $15 price target that suggests a robust ~108% upside for the next 12 months. (To watch Johnson’s track record, click here)

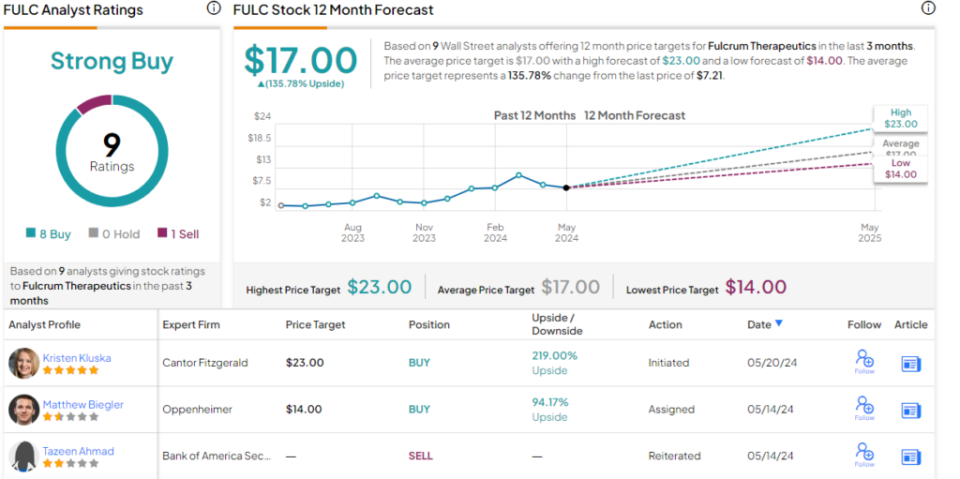

Overall, it’s clear that the Street agrees with the bullish take on this one. FULC shares base their Strong Buy consensus rating on 9 reviews, including 8 to Buy against just 1 to Sell. The stock is currently trading for $7.21, and its $17 average price target implies a one-year gain of ~136%. (See FULC stock forecast)

Marex Group (MRX)

Next up on our list is a financial services company. Marex Group is a broker-dealer on the global scene that provides a combination of market access, liquidity, and infrastructure services to a client base in the energy, commodity, and financial market communities. The company boasts more than 4,000 global customers, including producers and consumers of commodities, as well as asset managers and large banks. Marex operates mainly in Europe and the US but is expanding its activities into the Mid East and the Asia-Pacific region.

The company has five major business segments: Clearing, Agency & Execution, Market Making, Solutions, and Corporate. The largest of these is Agency & Execution, which makes up 46% of the company’s annual revenue. Among its other activities, this segment provides liquidity and matches buyers and sellers across various securities markets. The Clearing segment, generating 28% of revenues, handles the company’s Future Commission Merchant business. Last year, MRX was one of the US’s 10 largest FCM firms.

Marex operates out of 35 offices globally, through a group of branded subsidiary firms. Marex Group, as the parent company, entered the public trading markets through an IPO in April of this year, with the stock hitting the market at $19 per share and 3.846 million shares put on the market by the company. The IPO, which included a large tranche of privately sold shares, raised approximately $292 million.

On May 16, after the IPO dust had settled, Marex released its financial results for 2023. The company generated $1.245 billion in revenues for the year, up 75% from 2022. The company’s full-year, before-tax profit came to $197 million.

Goldman’s 5-star analyst Alexander Blostein is bullish on this new stock, writing in his initiation note, “We expect MRX to deliver an average EPS growth of ~20% through 2026 driven by healthy industry volumes, increasing market share gains, and expanding margins as the company scales. Under our assumptions, MRX is set to see revenue growth of ~13% through 2026, as the company continues to gain share in markets and geographies it had not previously competed in (namely Prime Brokerage Services through the Cowen acquisition, Fixed Income swaps clearing at LCH, and APAC expansion), with additional near-term tailwinds from higher rates and volatility. As the business scales, we see operating margins of 18%/19%/20% in 2024/25/26.”

Looking ahead, Blostein justifies an upbeat price target by noting MRX’s potential for growth, saying, “At ~8X 2024 P/E, MRX is meaningfully discounted relative to peers’ ~10Xaverage 2024 P/E, which we think is not warranted given the firm’s more diversified product set in terms of both products and geographies, superior revenue growth, and higher ROE.”

Accordingly, the analyst rates MRX shares a Buy, paired with a $33 price target that implies a 61% upside potential on the one-year horizon. (To watch Blostein’s track record, click here)

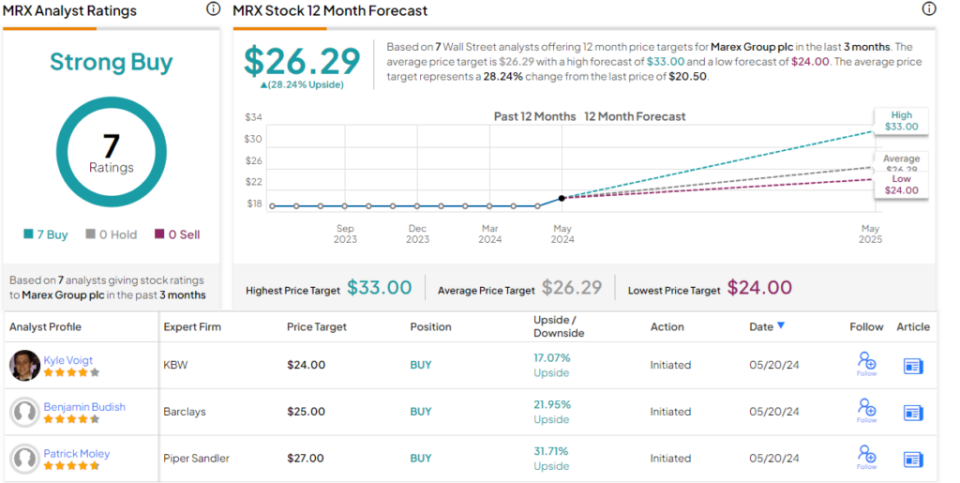

So far, all 7 of Marex’s stock reviews are positive, making the Strong Buy consensus rating unanimous. The shares are now trading for $20.50, and the $26.29 average target price suggests that MRX will gain 28% over the next year. (See MRX stock forecast)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analysts. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.