At the height of the American war machine’s realization that China controls nearly all of its raw materials, two new developments in Europe now suggest that the West has a fighting chance to secure critical metals for the future: A major discovery in Norway, and a potentially game-changing acquisition in Greenland.

In mid-June, Norwegian mining company Rare Earths Norway unveiled one of the largest deposits of rare earth elements in Europe in the Fen Carbonatite Complex in the country’s south. That discovery followed a vote in Norwegian parliament that paved the way for offshore, deep-sea mining of rare minerals in the country’s remote northern waters, Fortune magazine reported, making this the first country in Europe to allow such seabed mining activities.

At the same time, Critical Metals Corp (NASDAQ:CRML) announced an acquisition deal for what it believes is the largest critical metals deposit in the world, in Greenland.

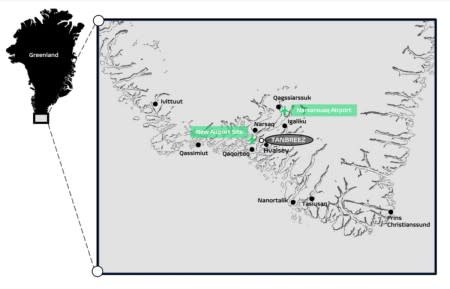

On June 10, Critical Metals Corp signed an agreement to acquire a controlling interest in Greenland’s Tanbreez project, which it says is the largest rare earth deposit in the world. Once operational, CRML expects it to supply Europe and North America. And on June 18 the company announced it had completed its initial investment for the Tanbreez acquisition, lending more confidence to the deal and further de-risking the transaction, according to a company press release.

Tanbreez is said to have over 28 million tonnes of total rare earth oxides, the company estimates internally, and nearly 30% of that is the most coveted “heavy” rare earth elements (HREE).

Given the success of MP Materials (NYSE:MP), a $2.2 billion market cap issuer that has a known resource of just under 3 million tonnes that is almost entirely light rare earth elements (LREE), CRML could be set for a significant valuation re-rate.

“Tanbreez is a game-changing rare earth mine for the West and a key step in positioning Critical Metals Corp as the leading supplier of critical minerals, CEO Tony Sage said in a press release.

Rare earths metals are used in our everyday electronics, but without them, there will be no clean energy transition, and the U.S. will find itself at a weapons disadvantage—a fearful thought at a time of geopolitical upheaval spreading across Europe and the Middle East.

With Russia and NATO constantly dipping their toes over their respective “red lines” on Ukraine, Russia making flanking movements in northern Africa and the Israel-Hamas conflict causing shifting global alliances and calculations, rare earths metals draw a line in the sand in the next global conflict.

That makes European discoveries all the more urgent, and Critical Metals is eyeing its potential to become one of the most important miners of the decade. And while heavy critical metals is golden goose in mining today, Critical Metals is also gearing up to develop the Wolfsberg Lithium Project in Austria, Europe’s first fully-permitted lithium mine.

China Is Wielding the Ultimate Weapon, Tanbreez Could be Frontline Defense

The two-pronged trade war has been well under way for some time now, and it’s all about the nexus of microchips and rare earth’s elements (REEs).

In August 2022, the Biden administration signed the CHIPS and Science Act into law to boost domestic manufacturing of semiconductors and reduce reliance on China. That move was in response to Beijing’s move to tighten exports of rare earths elements gallium, germanium and graphite. In late 2023, Beijing tightened controls on exports of rare earths and then banned the export of rare earths extraction technology. The trade war pits semiconductors against REEs in actions and reactions by Beijing and Washington.

Everything going forward is about microchips. Artificial intelligence (AI), military defense, and absolutely everything in between. It’s all powered by chips, which do not exist without the REEs necessary to make them.

That’s why the Tanbreez acquisition is so significant. The mine is positioned to become a major REE supply chain for the western hemisphere in the face of a Chinese government that has the ability to severely disrupt the availability of nearly all critical metals.

The Chinese could almost instantly take 50% of rare earth oxide supply off the market, which would devastatingly affect U.S. defense systems, which are already stretched thin over Ukraine.

Tanbreez is a 4.7-billion-tonne Kakortokite outcropping ore body about which over 2,000 academic papers have been written. It contains economically attractive amounts of Zirconium, Tantalum, Niobium, Hafnium and REEs. Nearly 30% of the minerals, all of which are said to occur in significant size and quality, are the most valuable of heavy rare earths.

Source: Tanbreez.com

The project was awarded an exploitation license on August 13, 2020, and is now working on the final environmental permit before commencing mining operations in Greenland. Nearly 400,000 assays have already been taken from over 400 drill holes. And an SK-1300 is now underway on this 4.7-billion-tonne multi-element asset, which hosts 28.2 million tonnes of total rare earth oxides (TREO).

Tanbreez could unlock REE supply for the Western world.

And the Western world is growing desperate. The fear is that Beijing has all the leverage in this race. China has already halted exports of some REEs, and since China also processes its own REE raw materials, there is palpable fear that they could cut off the West entirely. That’s what makes this a game of chips and rare earths.

In fact, it was this fear, aired very publicly, that reportedly prompted Donald Trump in 2019 to float the idea among his aides of buying Greenland, an autonomous Danish territory, outright. Now, it is in American hands, through the normal channels of corporate acquisitions.

Tanbreez could hold the key not only because of its sheer size and scale, but also because an estimated 27.1% of the asset is believed to be comprised of the rarer and more valuable “heavy” rare earths elements (HREE). By comparison, other Western miners of REEs have assets with 0.03%-16% of HREE, and a larger percentage of LREEs, light rare earths elements.

LREEs are primarily used in the manufacturing of magnets, which are important components of electric vehicle motors, medical equipment, wind turbines and data storage systems. HREEs, on the other hand, are critical for national defense and vital for heavy weaponry, but are also used in fiber optics, medical equipment and hybrid vehicles.

A single DDG-51 Aegis Destroyer, for instance, requires a phenomenal 5,200 lbs. of REEs, while an F-35 fighter jet requires nearly 600 lbs.

Time is now running out, and Tanbreez could be the best shot at securing this supply chain for national defense.

Critical Metals Corp (NASDAQ:CRML) has what could shape up to be the largest deposit of HREEs in the world, and it already has an exploitation permit, with hundreds of thousands of assays already undergoing testing. From an infrastructure perspective, Tanbreez is also highly advantageous, with year-round direct shipping access through deep-water fjords that feed into the North Atlantic ocean.

“Everything in your mobile phone, everything in cars comes from these Rare Earth elements. Supercomputers in the future, quantum computing … The windmills that are up, all the magnets in there. It’s all Rare Earths,” Sage told Oilprice.com in a recent interview.

“And one thing we don’t like to talk about is all the missiles that are being used on the Ukraine war theater and the Israel-Hamas war theater at the moment. They all need to be replenished somehow, and again, that’s all Rare Earths. That’s why the West is so concerned that China could simply pull the plug,” Sage added.

The Lithium Icing on the Rare Earths Cake

CRML’s new operation is Tanbreez, but Lithium was its first success. In fact, the company will have the first fully licensed lithium spodumene mine in Europe.

In Austria, Critical Metal’s (NASDAQ:CRML) Wolfsberg Project is positioned in close proximity to large lithium import markets in Europe, such as Germany, Belgium, France, Italy and Spain, and planned battery projects in Hungary, Germany, Sweden and the United Kingdom, CRML’s CEO Tony Sage told Autofutures earlier in June.

The mine is fully permitted in perpetuity and is positioned to be the next producing lithium mine in the European Union, and the first to produce battery-grade lithium.

“Substantial exploration and development work has already been conducted by the previous owners including approx. 17,000m of drilling / 1,400m of underground decline, drives and crosscuts. We look forward building upon this foundation and advancing our development plans for this strategic and key asset for Europe’s EV supply chain,” he added.

The S-K 1300 was updated just last year, indicating a resource of 12.88 million tonnes at 1% Li2O in Zone 1. Critical Metals signed a binding, long-term lithium offtake agreement with BMW Group in December 2022. Wolfsberg is expected to be completed by 2026, with Critical Metals to supply BMW by 2027. Then, in June this year, BMW made a $15-million pre-payment to CMC, which will be repaid through equal setoffs against lithium delivered. European Lithium (ASX: EUR) has also entered into a binding agreement to build the first regional Lithium Hydroxide Refinery in Saudi Arabia, through a JV with Obeikan Investment Group. CMRL expects to benefit from this JV.

The company’s first goal–to become the first local, battery-grade lithium supplier into an integrated European battery supply chain—was big enough.

Its new goal is to secure one of the largest rare earth’s deposits in the world for national defense, and the results of tests on hundreds of thousands of assays could turn out to be a significant response to China in the coming weeks, months, and years.

The markets don’t seem to have realized the full extent of the acquisition and what it means for the West and the company itself. That will probably change over the coming months as the story is only just making its way into the mainstream media.

Here are some other companies in the critical resources space worth following:

BHP Group (NYSE:BHP), a global resources giant, showcases a diversified portfolio encompassing iron ore, copper, coal, nickel, and energy operations. With a substantial presence in Australia and the Americas, BHP’s operational scale is impressive. The company’s commitment to sustainable practices, including environmental impact reduction and community engagement, further solidifies its position as a responsible and forward-thinking leader in the global resources sector.

FMC Corporation (NYSE: FMC) Based in Philadelphia, FMC Corporation is a global agricultural sciences company delivering innovative technology to growers worldwide and has a significant stake in lithium for rechargeable batteries and other high-tech applications. The company’s agricultural products contribute to increased crop yield and quality, addressing global food security issues. FMC’s commitment to innovation and sustainability has driven robust demand for its crop protection products, supported by higher commodity prices and strong agricultural market fundamentals.

Lithium Americas (NYSE:LAC) has emerged as a significant player in the lithium market, driven by the growing demand for lithium-ion batteries in electric vehicles and renewable energy. The company’s Thacker Pass project in Nevada holds the potential to be one of the world’s largest lithium sources, positioning Lithium Americas as a major contributor to the global lithium supply chain. Strategic investments and partnerships with established industry players further enhance the company’s prospects for growth and expansion.

Albemarle Corporation (NYSE:ALB) stands as a global specialty chemicals leader, distinguished by its position as the world’s largest lithium producer. This prominence in the lithium market aligns with the surging demand for electric vehicle batteries, a key growth driver for the company. Albemarle’s diversified portfolio, encompassing bromine, catalysts, and pharmaceuticals, showcases its adaptability and commitment to innovation across various sectors.

Piedmont Lithium Limited (NASDAQ:PLL) is an Australian mining company focused on developing lithium resources in the United States. Its flagship Piedmont Lithium Project in North Carolina is projected to produce a substantial amount of lithium hydroxide annually, catering to the increasing demand for lithium-based products. Piedmont Lithium’s strategic partnerships with industry leaders like LG Chem highlight its commitment to building a robust supply chain for the burgeoning electric vehicle market.

MP Materials Corp. (NYSE:MP) holds a unique position as the sole operator of a fully integrated rare earth mining and processing facility in the United States. The company’s focus on producing rare earth oxides and metals, critical components in various technologies, is particularly significant given the growing demand for these materials in emerging sectors like renewable energy and electronics. MP Materials’ vertical integration model ensures quality and consistency in its products, further strengthening its market position.

Rare Element Resources Ltd. (TSX:RES) is dedicated to the exploration and development of rare earth elements (REEs), crucial components in clean energy technologies. The company’s flagship Bear Lodge project in Wyoming, recognized as one of the world’s largest undeveloped REE deposits, holds immense potential to contribute to the global supply of REEs. REE’s commitment to sustainable and responsible mining practices underscores its dedication to ethical resource extraction and environmental stewardship.

Avalon Advanced Materials Inc. (TSX:AVL) is a Canadian company specializing in developing and manufacturing specialty materials for diverse industries. With expertise in high-purity metals and alloys used in electronics, aerospace, and biomedical applications, Avalon plays a vital role in advancing various technological fields. The company’s focus on developing materials for energy storage solutions, particularly lithium-ion and solid-state batteries, demonstrates its commitment to innovation and addressing the evolving needs of the market.

First Quantum Minerals Ltd. (TSX:FM) is a Canadian mining and metals company with a diverse global portfolio. The company’s operations span multiple countries and encompass the production of copper, nickel, gold, and zinc. First Quantum’s commitment to responsible mining practices and community engagement is evident in its efforts to create economic opportunities and minimize environmental impact in the regions where it operates.

Allkem Limited (TSX:AKE), an Australian mining company, is a significant player in the lithium market. Its diverse portfolio of lithium projects in Australia, Argentina, and Canada, including a substantial presence in the lithium-rich Salar de Atacama, positions it as a major contributor to the global lithium supply chain. Allkem’s integrated approach to lithium production, spanning exploration, production, and refining, solidifies its role in meeting the growing demand for lithium in the electric vehicle and renewable energy sectors.

Teck Resources Limited (TSX:TECK), a Canadian mining powerhouse, is a leading producer of zinc and copper. Its extensive operations in Canada, the United States, Chile, and Peru contribute significantly to the global supply of these essential metals. Teck’s zinc production is particularly noteworthy due to its critical role in various battery technologies, aligning with the increasing demand for energy storage solutions across multiple industries.

By. Tom Kool