One of the best ways to understand what the “smart money” on Wall Street is thinking is by combing through quarterly 13F filings. Large hedge funds must file a 13F every quarter, disclosing which stocks they are buying, holding, and selling.

One of the best money managers of the past 30 years has been David Tepper of Appaloosa Management. Between 1993 and 2013, Tepper averaged a stunning 40% annualized return, and has had a roughly 23%-25% net historical return from 1993 until today.

Needless to say, investors may be interested to know which stocks Tepper likes at the moment. With an appetite for both high-quality growth stocks and bargain-priced value stocks, Tepper appears to have swapped one type of stock for the other in the first quarter 2024.

Trimming the Magnificent Seven for the “Magnificent Seven” of China

Tepper has clearly benefited from a bet on the artificial intelligence wave, with many of his top holdings entering 2024 in leading Magnificent Seven stocks or large-cap semiconductor stocks, with both categories benefiting handsomely from the AI revolution sweeping over corporate America.

But in the first quarter, Tepper trimmed the vast majority of these leading U.S.-based technology stocks and reinvested the winnings into the Chinese tech sector — essentially swapping out five U.S. Magnificent Seven stocks for a basket of “Magnificent Seven-type” Chinese tech stocks.

Appaloosa’s new buys included four stocks, Alibaba, PDD Holdings (formerly Pinduoduo), Baidu, and JD.com, along with two China-focused exchange-traded funds (ETFs), the iShares China Large-Cap ETF and the tech-focused KraneShares CSI China Internet ETF.

|

Company |

% Increase From Prior Quarter |

% of Appaloosa Portfolio End of Q1 2024 |

|---|---|---|

|

Alibaba (NYSE: BABA) |

158.6% |

12.05% |

|

PDD Holdings (NASDAQ: PDD) |

171% |

3.61% |

|

Baidu (NASDAQ: BIDU) |

188% |

2.81% |

|

iShares China Large-Cap ETF (NYSEMKT: FXI) |

New |

2.27% |

|

JD.com (NASDAQ: JD) |

New |

1.48% |

|

KraneShares CSI China Internet ETF (NYSEMKT: KWEB) |

New |

1.35% |

Data source: Whalewisdom.

As you can see, Tepper has made a really big bet on Alibaba, making it his largest position at this time. But the optimism likely extends to the broader Chinese tech sector and really the entire country’s economy. While there is a big bet on tech stocks here, the FXI ETF does contain some state-owned and publicly owned banks as well in its top 10 holdings.

Basically, Tepper and his team may have concluded a long-awaited turnaround for the Chinese economy may be at hand.

China’s economy may be picking up

China’s economy has really been in a downturn since COVID-19, as the country wouldn’t use U.S. vaccines and therefore tried to lock down the country every time there was a new outbreak, disrupting business. Furthermore, the government decided to bring the regulatory hammer down on the country’s leading technology companies, limiting their growth and often suggesting or mandating breakups and asset divestitures. Furthermore, China pricked its real estate bubble, causing many large property developers to go bankrupt, leaving many pre-paid housing projects unfinished.

But in the last year or so, the government seems to have done an about-face, easing the regulatory burden on technology companies while attempting to stimulate its economy and encourage growth. The result has been six straight months of positive growth in China’s manufacturing sector, as shown by the Caixin/S&P Global manufacturing PMI. And perhaps most importantly, Chinese officials have recently contemplated buying unfinished housing projects from bankrupt developers and turning them into affordable housing or rental properties. Healing the property sector would be a key to stabilizing the Chinese economy.

China’s tech giants are extremely cheap

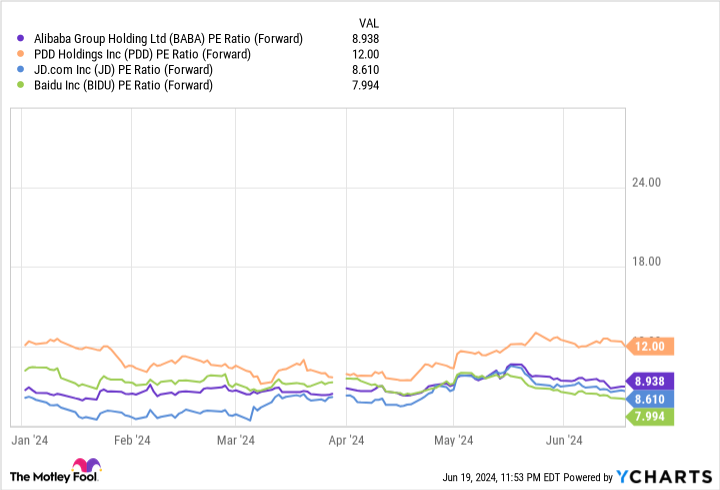

It appears Tepper’s team may have anticipated growth picking up in the country, or that AI may help China’s tech giants as they have U.S. tech stocks. Meanwhile, China’s leading tech stocks have fallen to absolute bargain-basement valuations, especially compared with high-flying U.S. tech stocks. PDD Holdings now trades at just 12 times earnings, while Alibaba, JD, and Baidu each trade between 8 and 9 times this year’s earnings estimates.

In light of the cheap valuations and growth picking up, most Chinese tech companies have been streamlining costs and launching large share repurchase programs. Alibaba raised its buyback authorization by $25 billion in the first quarter and repurchased $4.8 billion worth of its stock in Q1, lowering its share count by 2.6% in just one quarter alone. JD.com repurchased $1.2 billion, or 2.8% of its shares, in the first quarter, before authorizing another $3 billion program. And Baidu authorized a $5 billion share repurchase program in February, buying back $898 billion of its stock this year as of its first-quarter earnings report.

Thus, it’s perhaps not surprising to see Tepper trim some of his U.S. AI winners while rebalancing into much cheaper Chinese tech stocks buying back their stock, especially if he and his analysts also believe the Chinese economy will continue to recover.

Should you invest $1,000 in Alibaba Group right now?

Before you buy stock in Alibaba Group, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Alibaba Group wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $801,365!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of June 10, 2024

Billy Duberstein and/or his clients have no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Baidu and JD.com. The Motley Fool recommends Alibaba Group. The Motley Fool has a disclosure policy.

Billionaire David Tepper Goes Bargain Hunting: 6 Stocks He Just Bought was originally published by The Motley Fool