The “Magnificent Seven” is a moniker used to collectively describe the world’s largest technology businesses — Apple, Microsoft, Nvidia, Alphabet, Amazon (NASDAQ: AMZN), Meta, and Tesla.

An interesting characteristic of the Magnificent Seven is that each business is so diverse and spans so many different end markets that this megacap cohort can shed a lot of light on the overall health of the economy.

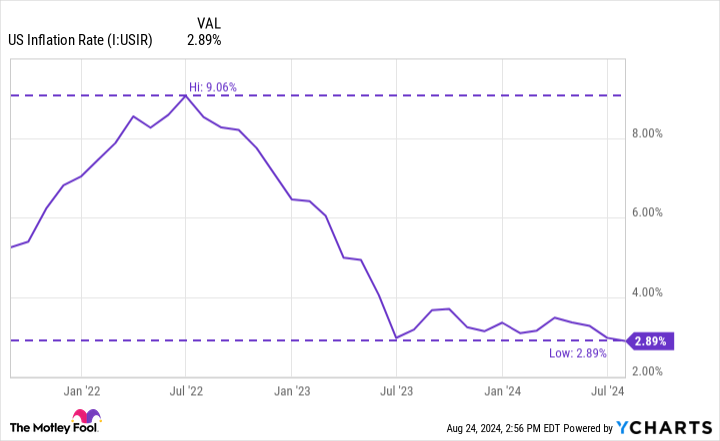

Investors know that two prominent themes of the macro environment over the last couple of years are lingering inflation and high interest rates. But just a couple of days ago at the Economic Policy Symposium in Jackson Hole, Wyoming, Federal Reserve Chair Jerome Powell said, “The time has come for policy to adjust.”

That sounds like interest rate cuts to me. Should the Fed begin tapering rates, I think there’s a good case to be made that each of the Magnificent Seven stocks will continue roaring.

However, I see Amazon as the candidate with the most upside. Let’s explore how changes in monetary policy could supercharge Amazon and assess why now looks like a lucrative opportunity to buy the stock.

A new spark for e-commerce

Amazon’s largest source of revenue stems from its e-commerce marketplace. The table below illustrates annual revenue growth trends related to Amazon’s online marketplace over the last year.

|

Category |

Q2 2023 |

Q3 2023 |

Q4 2023 |

Q1 2024 |

Q2 2024 |

|---|---|---|---|---|---|

|

Online stores |

5% |

6% |

8% |

7% |

6% |

|

Physical stores |

7% |

6% |

4% |

6% |

4% |

|

Third-party seller services |

18% |

18% |

19% |

16% |

13% |

|

Subscription services |

14% |

13% |

13% |

11% |

11% |

Data source: Investor Relations.

Notice any patterns? Growth over the last year among physical stores, commissions from third-party sellers, and subscriptions such as Amazon Prime have all decelerated. While sales from online sales have improved modestly, the quarterly results have been pretty inconsistent.

This shouldn’t come across as a surprise, though. Although inflation cooled dramatically in 2023, inflation still lingers. Goods and services are continuing to rise in price, just not as rapidly. When you layer abnormally high inflation with rising interest rates, it’s not entirely surprising to see a slowdown in online shopping and subscription services.

If the Fed does introduce a rate cut in September, I think such a move will be very well received. Even a modest reduction to borrowing costs can go a long way for consumer purchasing power. I think rate cuts will serve as a catalyst for Amazon’s e-commerce segment and ignite some newfound growth for the company’s largest business.

Moreover, I think Amazon’s e-commerce partnerships with social media powerhouses look all the more savvy now that rate cuts appear to be drawing closer.

More investments in artificial intelligence (AI)

Even though Amazon’s e-commerce business has faced an uphill battle over the last year, the company has been able to generate growth from other sources. Namely, cloud computing platform Amazon Web Services (AWS) has been a major beneficiary of the artificial intelligence (AI) revolution.

Similar to my e-commerce thesis, I think rate cuts will provide corporations of all sizes with some newfound financial flexibility. In turn, AWS looks poised for some acceleration as businesses continue to increase investments in AI applications.

Why Amazon stock looks primed to thrive right now

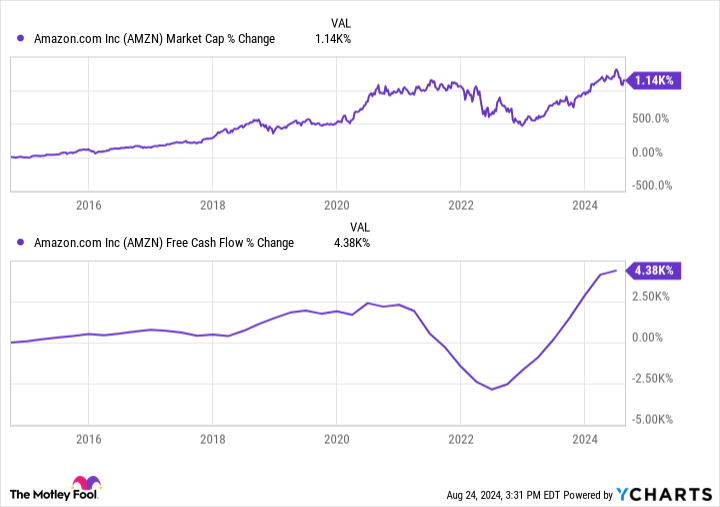

For the trailing 12 months ended June 30, Amazon generated $53 billion of free cash flow — an increase of 572% year over year. Considering Amazon’s total revenue is only growing 10% year over year, it’s incredible to see such a significant increase in profitability metrics.

Over the last 10 years, Amazon’s market capitalization has risen about 1,140%. Over this same time frame, the company’s free cash flow has grown roughly fourfold.

Amazon’s current price to free cash flow (P/FCF) ratio is 38.9. By comparison, the company’s 10-year average P/FCF ratio is about 84. This means that Amazon stock is technically more reasonably priced today than it was a decade ago, despite evolving into a much larger, complex enterprise spanning a multitude of new market opportunities.

To me, investors are really overlooking Amazon stock right now and not entirely capturing just how quickly the company can mint new levels of profitability. Amazon has managed to grow free cash flow exponentially even during a time of unpredictable sales growth, but I don’t think the current valuation fully reflects this dynamic.

With loads of cash on the balance sheet and the possibility of interest rate cuts looming, I think Amazon’s business is about to be supercharged by rejuvenated consumers and corporations alike, and see now as a terrific time to load up on shares.

Should you invest $1,000 in Amazon right now?

Before you buy stock in Amazon, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Amazon wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $731,449!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of August 26, 2024

Suzanne Frey, an executive at Alphabet, is a member of The Motley Fool’s board of directors. Randi Zuckerberg, a former director of market development and spokeswoman for Facebook and sister to Meta Platforms CEO Mark Zuckerberg, is a member of The Motley Fool’s board of directors. John Mackey, former CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool’s board of directors. Adam Spatacco has positions in Alphabet, Amazon, Apple, Meta Platforms, Microsoft, Nvidia, and Tesla. The Motley Fool has positions in and recommends Alphabet, Amazon, Apple, Meta Platforms, Microsoft, Nvidia, and Tesla. The Motley Fool recommends the following options: long January 2026 $395 calls on Microsoft and short January 2026 $405 calls on Microsoft. The Motley Fool has a disclosure policy.

1 “Magnificent Seven” Stock That Could Go Parabolic if the Fed Cuts Rates in September was originally published by The Motley Fool