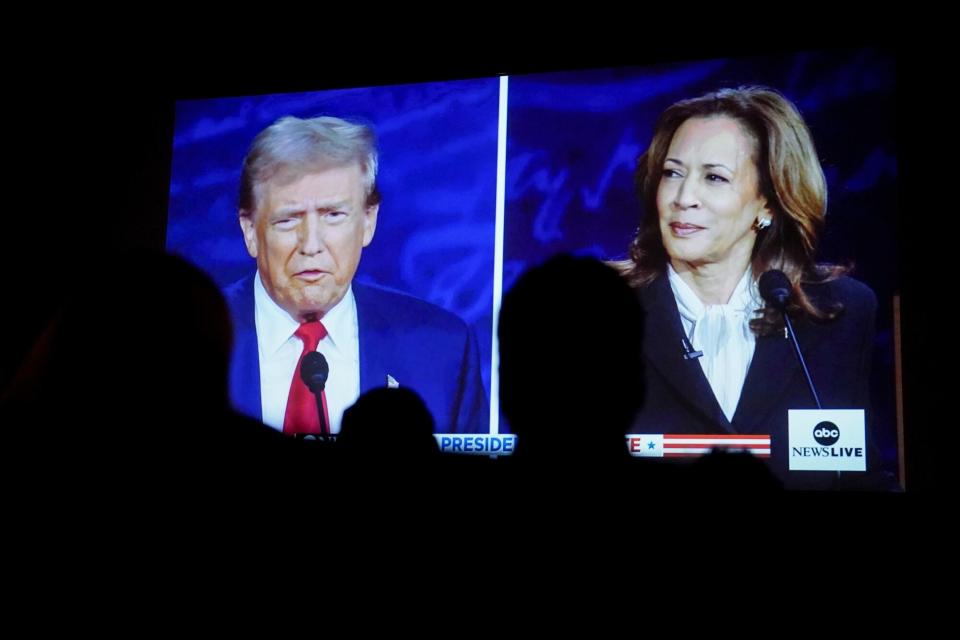

(Bloomberg) — Bitcoin (BTC-USD) slid as investors reacted to the US presidential debate between Democratic nominee Kamala Harris and Republican rival Donald Trump, who has embraced the crypto sector.

Most Read from Bloomberg

The digital asset fell as much as 2.6% before paring some of the drop to trade at $56,490 as of 7:40 a.m. Wednesday in London. In wider markets, US equity futures, a dollar gauge and Treasury yields retreated, while the yen climbed.

The original cryptocurrency is one of a number of so-called Trump trades because of the former president’s avowed support of the digital-asset industry. Bitcoin was thus in the spotlight as something that might provide clues on who gained the upper hand in the debate.

Trump was often on the defensive in the discussion as Vice President Harris peppered in lines that appeared designed to needle the Republican nominee. Pop icon Taylor Swift announced her endorsement of Harris minutes after the debate wrapped up. The odds reflected by betting markets moved in Harris’s favor in the wake of the face off on Tuesday night in Philadelphia.

Debate assessment

“The market assessed Kamala Harris won the debate, in particular in the early stages, which translated into a small move down for crypto,” said Caroline Mauron, co-founder of Orbit Markets, a provider of liquidity for trading in digital-asset derivatives.

Harris has yet to detail a policy position on crypto. Last month, an adviser to her campaign said Harris will back measures to help grow the industry. The adviser also signaled ongoing interest in implementing safeguards.

Trump has pivoted to courting the digital-asset sector in search of donations and votes amid a tight race for the White House, even vowing to make the US the “crypto capital of the planet.” His stance is an about-face given that the former president previously dubbed the sector a “scam.”

Crypto projects

The Republican nominee recently put out his fourth collection of nonfungible tokens. These NFTs, representing ownership of assets like images depicting Trump riding a motorcycle or as a boxer, have earned millions of dollars.

Trump and his sons Eric and Don Jr. have also been promoting World Liberty Financial, a planned initiative in crypto’s niche decentralized finance sector. Details remain scarce, and hackers last week briefly compromised some Trump family social media accounts to issue a fake post about the project.

The digital-asset industry has become an influential player in the presidential election through big donations to political action committees. Crypto businesses are seeking friendlier regulations, pushing back against the critical stance adopted by the Securities & Exchange Commission under Chair Gary Gensler.

Bitcoin jumped to a record $73,798 in March, fueled by demand for dedicated US exchange-traded funds. The rally cooled but the gains have nonetheless dulled memories of a deep bear market in 2022 and a string of collapses, including the wipeout of the FTX exchange — one of the biggest financial frauds in US history.

Most Read from Bloomberg Businessweek

©2024 Bloomberg L.P.