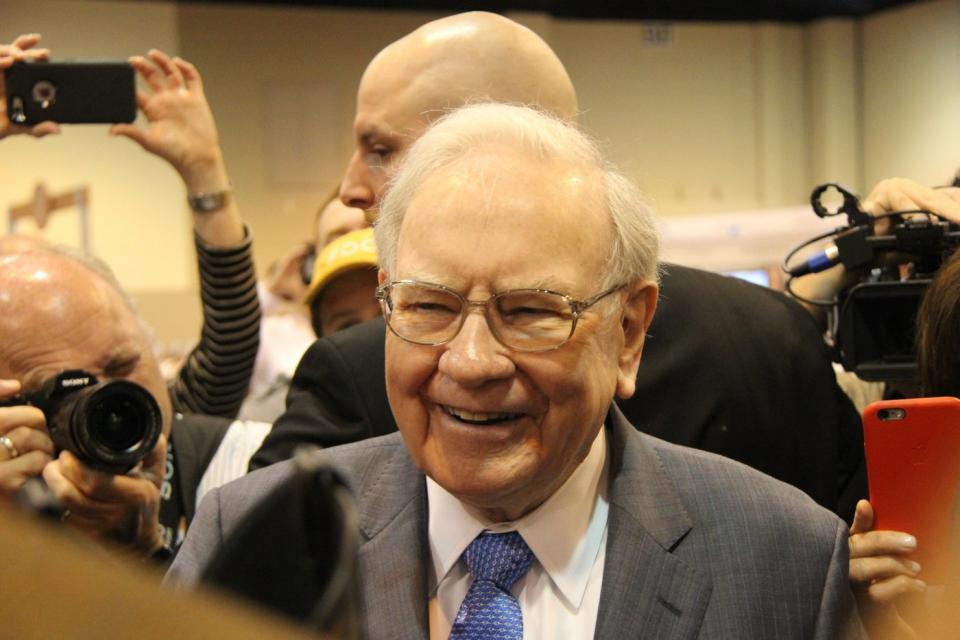

Warren Buffett, CEO of Berkshire Hathaway, oversees a portfolio of 45 publicly traded stocks and securities worth $315 billion, in addition to a $277 billion cash pile and numerous private, wholly owned businesses.

Buffett has a remarkable track record. His investment picks have propelled Berkshire stock to a compound annual return of 19.8% since he took the helm in 1965, crushing the 10.2% average annual gain in the S&P 500 (SNPINDEX: ^GSPC) index over the same period.

Buffett knows average investors would struggle to replicate his returns by picking individual stocks, so he often recommends they buy exchange-traded funds (ETFs) instead. And Berkshire has two in its portfolio: the Vanguard S&P 500 ETF (NYSEMKT: VOO), and the SPDR S&P 500 ETF Trust.

Both are designed to track the performance of the S&P by holding the same stocks and maintaining similar weightings, but the Vanguard ETF is cheaper to own (which I’ll discuss further in a moment), so let’s focus on that one.

If one particular Wall Street analyst is right, it could be poised for 163% upside by 2030!

Why the Vanguard S&P 500 ETF is a great choice for investors

The S&P 500 has strict entry criteria. Companies need to have a market capitalization of at least $18 billion and must be profitable. Even then, admission is at the discretion of a committee, which rebalances the index once every quarter.

As a result, investors can rest assured they are buying exposure to the highest quality companies when they put money into the Vanguard S&P 500 ETF. And it has an expense ratio of 0.03% (the proportion of the fund deducted each year to cover costs), making it far cheaper to own than the SPDR ETF, which has an expense ratio of 0.09%.

The ETF is made up of 11 different sectors. Technology is the largest with a 31.1% weighting, followed by financials at 13.2%, and healthcare at 12.2%. The tech industry is likely to drive the S&P higher for years because it’s home to the world’s most valuable companies, and the index is weighted by market capitalization.

The top five holdings in the Vanguard S&P 500 ETF have a combined market cap of $12.9 trillion, accounting for just over 25% of the total value of its entire portfolio of 500 companies:

|

Stock |

Vanguard ETF Portfolio Weighting |

|---|---|

|

1. Apple |

6.97% |

|

2. Microsoft |

6.54% |

|

3. Nvidia |

6.20% |

|

4. Amazon |

3.45% |

|

5. Meta Platforms |

2.41% |

Data source: Vanguard. Portfolio weightings are accurate as of Aug. 31 and are subject to change.

Apple just launched its new iPhone 16 Pro. It’s fitted with the latest A18 Pro chip, which is designed to process artificial intelligence (AI) workloads on the device, so it’s ready for the launch of the Apple Intelligence software later this year. It was developed in partnership with OpenAI, and it will give users powerful new writing tools and transform the Siri voice assistant with new capabilities powered by ChatGPT.

Microsoft and Amazon have developed their own AI chatbots and virtual assistants. Businesses can also access the latest large language models (LLMs) and the computing power required to develop AI applications through the Microsoft Azure and Amazon Web Services cloud platforms.

None of the above would be possible without Nvidia, which supplies the most powerful data center chips in the world for developing AI. Right now, the company can’t keep up with demand from tech giants including Microsoft, Amazon, Meta, OpenAI, Tesla, Oracle, and others, which are battling for AI supremacy.

The Vanguard ETF could be poised for 163% upside by 2030

Wall Street analysts don’t always get things right, but Fundstrat Global Advisors managing partner Tom Lee has made some very accurate S&P 500 predictions over the last couple of years:

-

He said the S&P would reach 4,750 in 2023, and it closed the year at 4,769.

-

He entered 2024 with a 5,200 target, which was surpassed within the first three months.

-

He then said the index would hit 5,500 in June, and it did.

Lee’s most recent year-end forecast is for 5,700 on the S&P. Considering it closed at 5,702 on Sept. 20, it looks like he will add that to his list of successful calls.

Earlier this year, he also issued a long-term forecast suggesting the index could surpass 15,000 by 2030. That implies an upside of 163% from here, which is the return investors could expect from the Vanguard S&P 500 ETF if he’s right.

Lee says AI will be a key driver behind the move. He estimates the global workforce will be short 80 million workers by the end of this decade, which will drive more investment into AI technologies to automate more jobs.

He also says there is a huge demographic tailwind coming, with millennials and Gen Zers entering the prime period of their lives (between 30 and 50 years of age). That’s when people are earning the most money, and when they are making big life decisions like investing.

Of course, there are risks. A global recession could add years to Lee’s 15,000 target, and if AI fails to live up to the hype, some of the world’s largest stocks I highlighted earlier could suffer a prolonged period of underperformance.

With all of that said, even if the S&P 500 doesn’t reach 15,000 by 2030, history suggests it’s likely to get there eventually, so investors should definitely consider taking Buffett’s advice and buying the Vanguard S&P 500 ETF.

Should you invest $1,000 in Vanguard S&P 500 ETF right now?

Before you buy stock in Vanguard S&P 500 ETF, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Vanguard S&P 500 ETF wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $710,860!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of September 23, 2024

John Mackey, former CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool’s board of directors. Randi Zuckerberg, a former director of market development and spokeswoman for Facebook and sister to Meta Platforms CEO Mark Zuckerberg, is a member of The Motley Fool’s board of directors. Anthony Di Pizio has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Amazon, Apple, Berkshire Hathaway, Meta Platforms, Microsoft, Nvidia, Oracle, Tesla, and Vanguard S&P 500 ETF. The Motley Fool recommends the following options: long January 2026 $395 calls on Microsoft and short January 2026 $405 calls on Microsoft. The Motley Fool has a disclosure policy.

Warren Buffett Owns 1 Vanguard ETF That Could Soar 163%, According to a Top Wall Street Analyst was originally published by The Motley Fool