One of the most visible big-name investors on Wall Street is Ark Invest CEO Cathie Wood. Wood invests in many areas of emerging technology including artificial intelligence (AI) and genomics.

But perhaps Wood’s most bullish stance revolves around electric vehicle (EV) company Tesla (NASDAQ: TSLA). Wood has been a longtime supporter of Tesla’s eccentric CEO Elon Musk who shares his vision of the company spanning beyond EV production.

Given the company’s inroads with autonomous driving and robotics, Wood recently referred to Tesla as the biggest AI play in the world. To back up her claim, Wood’s research suggests that Tesla stock could grow by another 777% over the next three to four years.

Let’s dig into the state of Tesla’s operation and assess if Wood’s price target is feasible.

Tesla’s incredible run

Since its initial public offering (IPO) in 2010, Tesla’s stock price has risen over 14,000%.

While that makes Tesla one of the best-performing stocks in recent history, the chart above illustrates that the journey has been anything but linear. While Tesla has garnered its share of institutional support from the likes of Wood and mutual fund manager Ron Baron, the company is also a favorite among retail investors. A lot of that has to do with Musk’s infatuation with meme culture and his large presence on social media.

Nevertheless, despite some controversies, Musk and his team have always found a way to deliver. As such, confidence in Tesla has gradually risen and the company is now one of the world’s largest enterprises by market cap.

Given this stunning growth, Tesla stock has experienced periods of more pronounced buying activity and its valuation has become overextended. To mitigate some of this, Tesla has undergone two stock splits in the last four years — once in 2020 and another in 2022.

While stock splits do not inherently change the value of a company, seasoned investors probably understand that more investors tend to buy in after these events occur. This is usually due to a psychological perception that the stock is cheaper given its now lower share price.

As of now, Tesla’s split-adjusted stock price is around $228. But with so many AI catalysts on the horizon, could Wood’s forecast of $2,000 per share be reasonable?

What is behind Wood’s assumptions?

The biggest drivers behind Wood’s financial model are the number of cars Tesla will be able to produce in the future, as well as additional revenue streams for the business.

By 2027, Wood assumes that only 47% of Tesla’s total revenue will be derived from EVs. This is because she believes that Tesla’s progress in self-driving car technology will put it at the forefront of a new industry. More specifically, Wood believes Tesla is on the verge of launching a robotaxi fleet. The advent of robotaxis could significantly impact ride-hailing and delivery businesses alike as it represents a major cost-savings opportunity.

Furthermore, Ark’s research suggests that the robotaxi business will carry much higher margins compared to Tesla’s EVs given their recurring revenue. Should this be the case, Tesla could enjoy accelerated profitability and free cash flow — which it can use to reinvest in more growth areas.

The combination of Tesla’s rising EV production, industry-leading battery technology, and the potential of autonomous driving results in an estimated share price of $2,000 by 2027 in Wood’s base case. Given Tesla’s current share price, Wood is calling for a nearly 800% increase within the next few years.

Should you invest in Tesla stock?

Going off of Wood’s forecast alone is not reason enough to believe Tesla stock has immense upside. While all eyes are on the company’s self-driving capabilities, Tesla has other use cases for AI as well. Its humanoid robot, Optimus, could upend the labor market and warehouse operations.

To me, the biggest question marks revolve around when Tesla will begin commercializing these new products. Although investors occasionally get updates on Tesla’s AI endeavors during earnings calls, it is not yet known how far away monetization is. These reasons make it obvious that Wood is assuming that a lot goes right for Tesla in a relatively short amount of time.

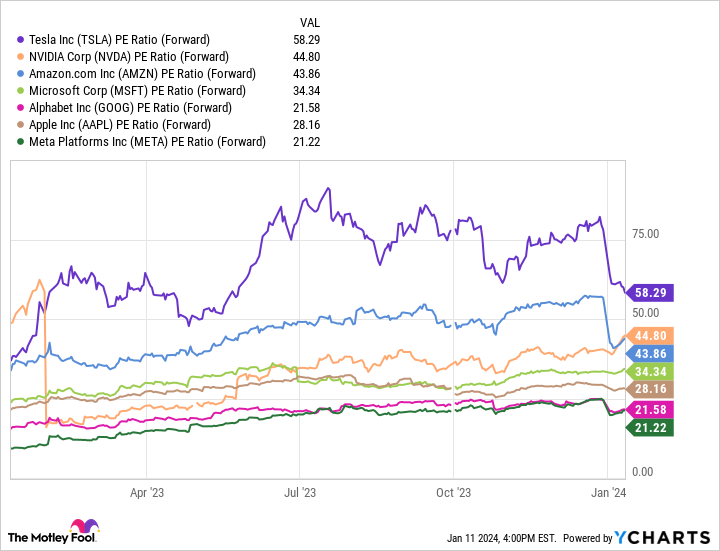

Tesla’s forward price-to-earnings (P/E) multiple of 58 is the highest among its Magnificent Seven cohorts and it’s not even close. I think this is a good indication that investors are broadly more bullish on Tesla’s prospects relative to other megacap tech companies. This could signal that the potential of AI is already priced into Tesla’s share price — at least to some degree.

I’ve held Tesla stock for years and plan to continue doing so. While her research is interesting to read, I am not overly concerned about (or overly confident in) Wood’s lofty price targets. For now, I’ll treat share price forecasts as speculation and instead continue monitoring Tesla’s operating results and AI roadmap. Overall, I think further gains are very much in store for Tesla shareholders, and I am excited to see how AI plays an integral role in the evolution of the business.

Where to invest $1,000 right now

When our analyst team has a stock tip, it can pay to listen. After all, the newsletter they have run for two decades, Motley Fool Stock Advisor, has more than tripled the market.*

They just revealed what they believe are the ten best stocks for investors to buy right now… and Tesla made the list — but there are 9 other stocks you may be overlooking.

*Stock Advisor returns as of January 8, 2024

Randi Zuckerberg, a former director of market development and spokeswoman for Facebook and sister to Meta Platforms CEO Mark Zuckerberg, is a member of The Motley Fool’s board of directors. John Mackey, former CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool’s board of directors. Suzanne Frey, an executive at Alphabet, is a member of The Motley Fool’s board of directors. Adam Spatacco has positions in Alphabet, Amazon, Apple, Meta Platforms, Microsoft, Nvidia, and Tesla. The Motley Fool has positions in and recommends Alphabet, Amazon, Apple, Meta Platforms, Microsoft, Nvidia, and Tesla. The Motley Fool has a disclosure policy.

Cathie Wood Thinks This Magnificent Artificial Intelligence (AI) Stock-Split Stock Could Surge 777% was originally published by The Motley Fool