Cathie Wood and Warren Buffett don’t have a ton in common.

Buffett is an investor who traditionally seeks steady growth and often looks for dividend plays. This simple investment strategy has become a modern-day staple for investors of all ages. On the other side, Wood has taken bullish stances on emerging markets such as artificial intelligence (AI), genomics, and many others.

Buffett, who long averted investments in the technology sector, shocked the world back in 2016 after taking a sizable position in Apple. The iPhone maker has rewarded Buffett handsomely, and now comprises nearly 50% of his Berkshire Hathaway portfolio.

While Buffett owns a finite number of stocks in the technology sector, there is one AI company in particular that he shares with Wood. E-commerce and cloud computing leader Amazon (NASDAQ: AMZN) are both held in Berkshire Hathaway and Wood’s exchange-traded funds (ETFs).

Investing along the lines of Buffett and Wood puts investors in some pretty good company. Let’s dig into Amazon stock and assess if now is a good opportunity to scoop up some shares.

How is Amazon disrupting AI?

To be clear, Wood and Buffett have each owned Amazon for several years — well before all the hype surrounding AI came about. Nevertheless, interest in artificial intelligence (AI) fueled tech stocks in particular last year and largely contributed to meaningful gains in the S&P 500 and Nasdaq Composite.

When it comes to AI, it seems like the majority of the chatter is garnered by Microsoft-backed ChatGPT. In addition, demand for semiconductors used to train generative AI models has resulted in a lot of attention around Nvidia and Advanced Micro Devices in particular. While it’s easy to become captivated by these exciting developments, investors should remember that there are many other players quietly making inroads in AI.

For Amazon, the company’s multibillion-dollar investment in an AI start-up called Anthropic could carry some lucrative tailwinds. As part of the deal, Anthropic will be using Amazon as its primary cloud provider. Over the last year, a sluggish macroeconomy has significantly impacted Amazon’s cloud growth.

However, the new partnership with Anthropic could be an opportunity to return to accelerated growth. Furthermore, Amazon’s new managed service, called Bedrock, is already experiencing positive momentum as applications leveraging large language models (LLMs), among other tools, become more of a fixture for corporate IT budgets.

Some things to keep in mind

When it comes to owning Amazon, there is something deeper that Wood and Buffett both share: The stock is an extremely nominal holding for them. For Wood, Amazon comprises just 0.06% of her total portfolio. Furthermore, the e-commerce giant represents a mere 0.40% of Berkshire Hathaway.

It’s important for investors to understand that following the moves of larger, more prominent funds is not a guarantee for success. Although institutional support can be viewed as a positive, investors should not take a position in a certain stock or asset just because a notable money manager did so.

Amazon stock looks like a bargain

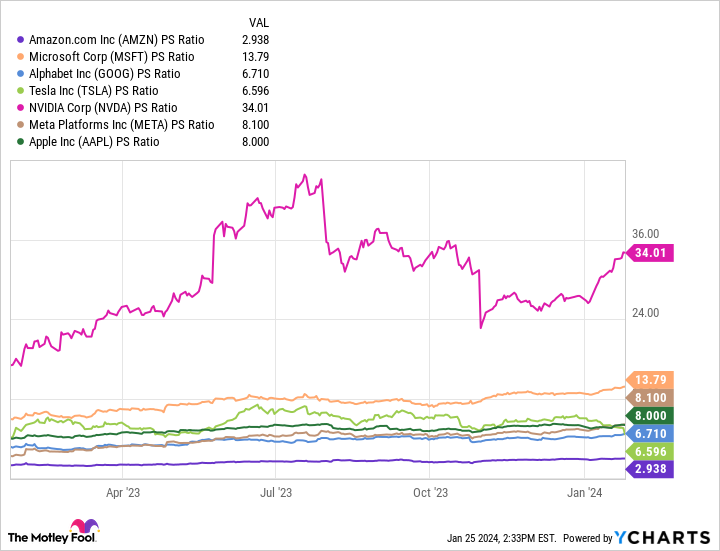

The chart illustrates the price-to-sales (P/S) multiple for Amazon benchmarked against a cohort of other megacap tech enterprises. At a P/S of just 2.9, Amazon is the least expensive stock in the “Magnificent Seven” based on this metric. Interestingly, this P/S level is also very much in line with Amazon’s 10-year average of 3.1.

I find this intriguing because over the last decade, Amazon has achieved quite a bit. The company is an undisputed leader among cloud providers, fending off stiff competition from the likes of Microsoft, Alphabet, and Oracle. Moreover, Amazon has entered several other end markets, including streaming and advertising. Now, with artificial intelligence being at the center of the next evolution of Amazon Web Services, the company’s return to accelerated revenue and free cash flow looks very much in sight.

I think investors are broadly miscalculating — perhaps underappreciating — Amazon’s potential within the AI landscape, and as such are discounting the stock relative to its peers. In turn, investors have been presented with a unique opportunity to buy shares at an attractive valuation. Now looks like a great time to employ a dollar-cost averaging strategy and begin building a long-term position in Amazon stock.

Should you invest $1,000 in Amazon right now?

Before you buy stock in Amazon, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Amazon wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than tripled the return of S&P 500 since 2002*.

*Stock Advisor returns as of January 22, 2024

John Mackey, former CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool’s board of directors. Suzanne Frey, an executive at Alphabet, is a member of The Motley Fool’s board of directors. Adam Spatacco has positions in Alphabet, Amazon, Apple, Microsoft, and Nvidia. The Motley Fool has positions in and recommends Advanced Micro Devices, Alphabet, Amazon, Apple, Berkshire Hathaway, Microsoft, Nvidia, and Oracle. The Motley Fool has a disclosure policy.

Cathie Wood and Warren Buffett Own This Artificial Intelligence (AI) Stock. And It Looks Dirt Cheap Right Now. was originally published by The Motley Fool