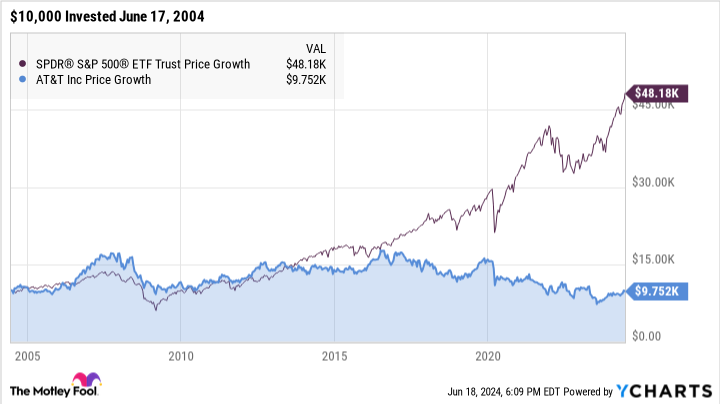

Investing in AT&T (NYSE: T) over the past two decades has delivered mixed results for long-term investors. Let’s break down what a $10,000 investment in AT&T would look like today, starting in June 2004.

20-year results

AT&T’s stock price has not shown significant appreciation over the past 20 years. Your hypothetical $10,000 investment would be worth $9,752 today. That’s a negative return, leaving you with less money than you originally invested. At the same time, the SPDR S&P 500 ETF Trust (NYSEMKT: SPY) turned the same $10,000 bet into $48,180.

But what if you also reinvested dividends in buying more shares along the way? Dividend reinvestment plans (DRIPs) can be game-changing tools in the long run, especially for generous dividend payers like AT&T.

On that note, AT&T’s total return almost caught up with the S&P 500 index tracker fund over the last 20 years:

Alright, I stretched the truth a bit there. AT&T’s dividend-powered total return nearly matched the dividend-free price gains of the S&P 500 in this period.

Not even the dividend boost made AT&T a winner

The key takeaway here is the undeniable power of dividends in long-term investing. While AT&T’s stock price performance was disappointing, the reinvested dividends significantly bolstered the overall return.

It’s worth noting that this period was arguably a golden age for AT&T, with the rise of ubiquitous cellphones, then smartphones, and successive waves of 3G, 4G, and 5G upgrades. Despite these tailwinds, AT&T’s dividend-boosted returns couldn’t match the broader market’s dividend-less gains. Ma Bell doesn’t impress me from a long-term perspective.

You may very well be better off with a simple S&P 500 index fund than this disappointing telecom giant.

Should you invest $1,000 in AT&T right now?

Before you buy stock in AT&T, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and AT&T wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $802,591!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of June 10, 2024

Anders Bylund has no position in any of the stocks mentioned. The Motley Fool has no position in any of the stocks mentioned. The Motley Fool has a disclosure policy.

If You’d Invested $10,000 in AT&T Stock 20 Years Ago, Here’s How Much You’d Have Today was originally published by The Motley Fool