Benzinga and Yahoo Finance LLC may earn commission or revenue on some items through the links below.

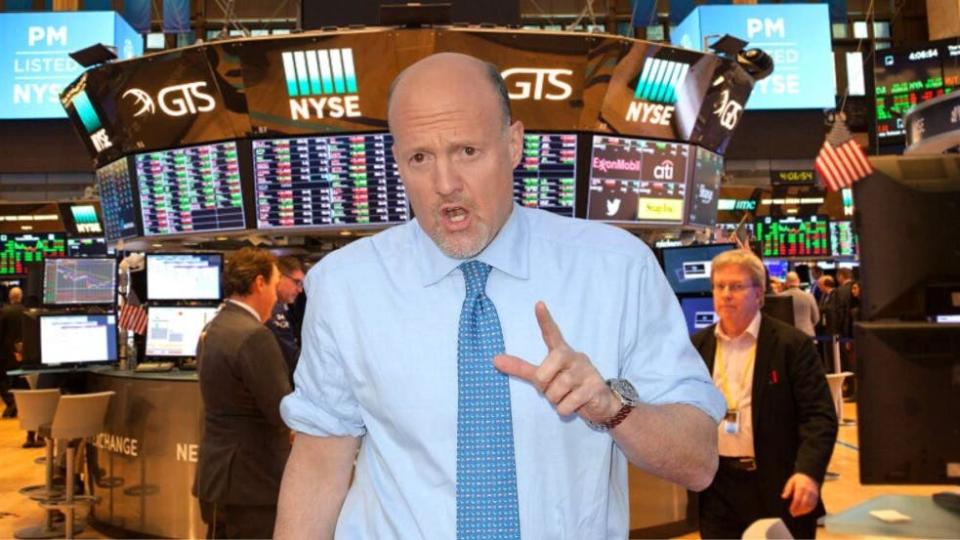

On CNBC’s “Mad Money Lightning Round,” Jim Cramer said he likes Blackstone Inc. (NYSE:BX). “They have a lot of great companies in house that are going to do very well,” he added. On July 18, Blackstone reported second-quarter fiscal year 2024 adjusted revenues of $2.796 billion, beating the consensus of $2.619 billion.

When asked about Borr Drilling Limited (NYSE:BORR), Cramer said he always goes with the best, which is Schlumberger NV SLB (NYSE:SLB).

On May 23, Borr Drilling reported better-than-expected first-quarter sales results and raised its dividend.

Don’t miss the real AI boom – here’s how to use just $10 to invest in high growth private tech companies.

This is a paid advertisement. Carefully consider the investment objectives, risks, charges and expenses of the Fundrise Innovation Fund before investing. This and other information can be found in the Fund’s prospectus. Read them carefully before investing.

Lowe’s Companies, Inc. (NYSE:LOW)is the kind of stock that should be bought right here, right now ahead of the Federal Reserve’s rate cut cycle. “I would pick some up tomorrow,” he added.

On May 31, the company declared a quarterly cash dividend of $1.15 per share, payable Aug. 7 to shareholders of record as of July 24.

“I was mystified and surprised at that conference call, which was absolutely terrible, Cramer said about DexCom, Inc. (NASDAQ:DXCM). “I think Abbott (NYSE:ABT) is a better play.” On July 25, DexCom reported worse-than-expected second-quarter revenue results and issued weak revenue guidance.

Don’t Miss:

When asked about Marvell Technology, Inc. (NASDAQ:MRVL), he said, “They’re two different things. Marvell the stock is probably being hurt, but Marvell the company, Matt Murphy [Chairman and CEO at Marvell] is doing a terrific job. I actually would own the stock.”

On July 30, the company introduced its Structera line of Compute Express Link (CXL) devices, designed to address memory performance and scaling challenges in general-purpose servers for cloud data centers.

The “Mad Money” host recommended selling Joby Aviation, Inc. (NYSE:JOBY) Joby Aviation will release its second quarter financial results after the closing bell on Wednesday, Aug. 7.

When asked about Edwards Lifesciences Corporation (NYSE:EW), he said, “You want to swap over to Boston Scientific (NYSE:BSX).”

On July 24, Edwards Lifesciences reported worse-than-expected second-quarter sales results and issued third-quarter guidance below estimates. Also, the company acquired JenaValve and Endotronix.

Read More:

This article Jim Cramer Says This Home Improvement Chain Is A Buy Ahead Of Fed Rate Cut Cycle: ‘I Would Pick Some Up Tomorrow’ originally appeared on Benzinga.com