Given the choice, most investors prefer buying stocks on a dip rather than during (or after) a rally. Why pay more when you can pay less? Paying less means more eventual profits.

Sometimes, though, it’s worth jumping into a stock while it’s on the way up. There may not be a pullback coming anytime soon. Waiting could end up being costly instead of helpful.

With that as the backdrop, here’s a closer look at three such soaring stocks to consider stepping into now despite their current strength. There’s too good of a chance for more immediate upside.

MercadoLibre

If you’ve never heard of MercadoLibre (NASDAQ: MELI), don’t sweat it. Plenty of people haven’t. That’s because it only operates its business in Latin America. But what a business it operates!

MercadoLibre is often referred to as the Amazon of Latin America, and it’s not an unfair description. It’s incomplete, though. In addition to its online malls as well as dedicated, company-specific shopping carts, this company also offers online and mobile payment services, plus logistics services to support these online operations. In many ways, the company’s just as much like Shopify, PayPal, and eBay. In fact, it was more of an eBay clone in its early days.

More important to current and prospective shareholders, MercadoLibre is very much in the right place at the right time with the right lineup of services.

How so? In many ways, South America is now where North America was 20 years ago. Although the region has certainly had high-speed internet and mobile phones for many years, these things are only just beginning to become common in the region. Atlantico reports that between 2012 and 2022, the continent’s internet penetration rate grew from 42% to 74%. That’s a big change in just one decade.

Yet, access to the web still isn’t universal. S&P Global Market Intelligence says that only a little over half of Latin America’s homes have access to broadband service, while market research firm Phocuswright suggests Latin America’s mobile phone penetration rate will only reach 75% by 2025.

The point is, while South America’s e-commerce industry may not yet compare to North America’s, the stage is set for massive growth as the industry matures there. A forecast from Payments and Commerce Market Intelligence indicates the region’s e-commerce market is likely to swell to the tune of 24% this year, and expand by 21% next year and then again the year after that. For its part, MercadoLibre is expected to grow its top line by 33% this year, and then another 24% in 2025.

Connect the dots. All the pieces of MercadoLibre’s puzzle are finally falling into place. That’s why the stock’s making forward progress. And there’s much more progress to be made ahead.

DraftKings

DraftKings (NASDAQ: DKNG) shares are up more than 300% since the end of 2022, and still within sight of the 52-week high hit in March. A move of that size can certainly be intimidating to would-be buyers.

Don’t be intimidated, though. This rally is likely to persist for a long while.

As you may already know, DraftKings is a sports-betting stock. While its roots are in the fantasy sports business, 2018’s lift of the federal ban on sports-based wagering started a wave of state-level legalization. As of the latest count, betting on sports is legal in one way or another in 38 U.S. states.

But that doesn’t mean most of DraftKings’ revenue and earnings growth is in the rearview mirror, for a couple of reasons.

First, two of the nation’s largest states, Texas and California, don’t yet permit sports betting. Legalization measures continue surfacing in both states, though, and it seems reasonable that it should happen sooner or later.

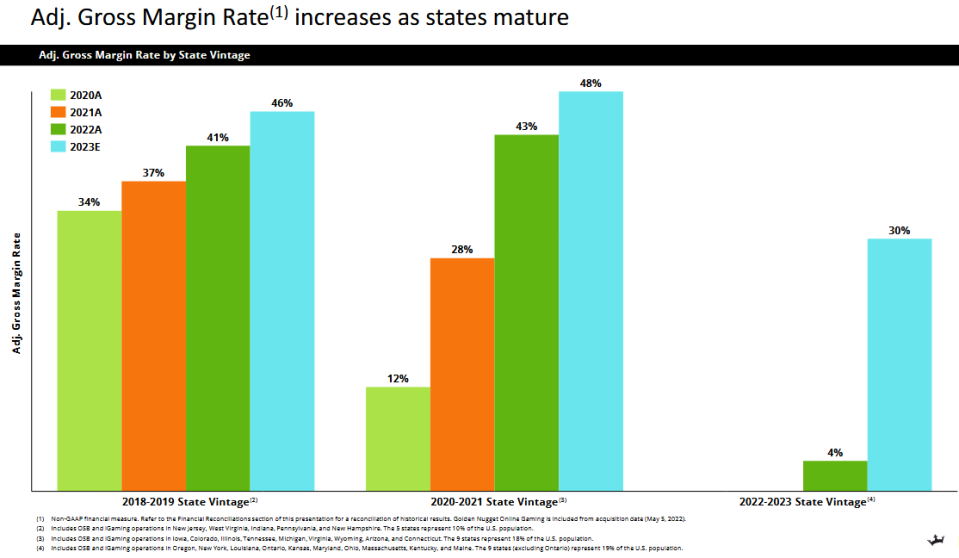

Second (and perhaps more important), it takes time for DraftKings’ business to reach its maximum potential even when a state legalizes its presence, just as it takes time for a bettor to become profitable once they become a DraftKings app user. The company reports the average customer doesn’t become gross profitable until the third year after they’re acquired, after they’ve been betting a while and tend to wager more.

This is noteworthy for one overarching reason: Many of DraftKings’ clients are just now nearing or have only recently passed their third year of being customers. That’s why last year’s per-share loss of $1.73 is expected to swing — dramatically — to a profit of $0.85 per share next year. The company is of course also bringing in more new users in the meantime, setting up even more profit growth three years after they’re garnered. This is a margin-expansion cycle that could last for years.

Walmart

Last but not least, add Walmart (NYSE: WMT) to your list of stocks you can still feel good about buying even though they’re flying.

The world’s largest retailer is just coming off of an incredible quarter. Revenue of $161.5 billion wasn’t just up nearly 6% year over year, but handily topped estimates of $159.5 billion. Earnings of $0.60 per share also beat estimates of only $0.52, growing 22% from the year-earlier comparison of $0.49 per share. Same-store sales in the U.S. improved by 3.8%, while its e-commerce business grew a hefty 21%.

In short, Walmart is firing on all cylinders. That’s why the stock jumped 7% on the day the report was released, pushing its way deeper into record-high territory. It’s now 63% above its mid-2022 low.

Don’t be too intimidated to dive in, though, at least after letting this past Thursday’s post-earnings dust settle. More bullishness may well be in the cards despite the stock’s trailing-12-month price-to-earnings valuation of over 27 (which is a lot by overall market standards). You’re paying the premium you can expect to pay for reliability, quality, and consistency.

See, although the company wasn’t in a position to do so just a few years prior, in many ways the COVID-19 pandemic — and then the post-pandemic fallout — has proven a business-building boon for the retailer. Walmart is one of the few retailers that’s been able to maintain the availability of a wide assortment of merchandise still sold at reasonably low prices. This is largely the result of sheer scale, and the leverage it’s used when dealing with its vendors.

A year ago, for instance, the company flat-out told its packaged consumer goods suppliers that it would no longer be paying their ever-rising prices. They needed to find a way of culling their own costs, or Walmart would begin working with alternative brands.

Since 2020, Walmart has also attracted a large number of customers living in households earning in excess of $100,000. After all, with overall consumer prices now 22% higher than they were four years ago, everyone’s feeling the pinch.

Of course, this tailwind could ease if the economy returns to normal. So far, though, the underlying idea of value-minded convenience seems to be the new norm, just as high prices appear here to stay. This clearly works in Walmart’s favor.

Should you invest $1,000 in MercadoLibre right now?

Before you buy stock in MercadoLibre, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and MercadoLibre wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $580,722!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of May 13, 2024

John Mackey, former CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool’s board of directors. James Brumley has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Amazon, MercadoLibre, PayPal, Shopify, and Walmart. The Motley Fool recommends eBay and recommends the following options: short July 2024 $52.50 calls on eBay and short June 2024 $67.50 calls on PayPal. The Motley Fool has a disclosure policy.

3 Soaring Stocks I’d Buy Now With No Hesitation was originally published by The Motley Fool